Automotive Direct Sales – Are Dealerships Becoming Irrelevant?

The automotive industry is embarking on a new journey — selling cars directly to consumers. This marks a shift from the traditional route of purchasing a vehicle from a dealership.

İçindekiler

In North America, dealerships have been the most popular way to buy cars since the early 20th century, beginning when William E. Metzger established the first car dealership in the US in 1898.

This model has been created due to the need for distributing vehicles across geographic areas and dealerships made it easier for consumers to access cars and manufacturers to reach a broader market by providing a local sales network. It allowed automakers to distribute their financial risks and cater to domestic markets without having the knowledge of customer preferences in different regions.

Moreover, regulatory frameworks, particularly franchise laws that vary between states, provide dealers with certain rights and protections. Dealerships also establish and maintain relationships with customers by providing them with services such as vehicle maintenance, repairs, and warranties, which enhances customer satisfaction and loyalty.

As a result, dealerships became the most popular way to sell cars, but the tide has started to change. Interestingly, a Gallup poll found that car salespeople ranked among the lowest in a list of professions in terms of their commitment to honesty and ethics. Ranking lower than lawyers, insurance salespeople, and even members of Congress, this suggests a clear public distaste for car dealerships.

The thing is, in the current world, where you can buy everything from your phone and right from the comfort of your home, you just can’t order a new car from your phone, something car manufacturers aim to change. The reason that you can’t do that is because of the state franchise laws, which prohibit auto manufacturers from directly selling their cars to customers. If it isn’t clear already, only dealers can sell new cars in the US.

However, before these laws were passed, the public had several options for buying cars: dealer franchises, wholesalers, retail stores, and more. But after Metzger purchased General Motors’s right to sell steam engine cars, it all became mandatory.

Initially, state franchise laws were designed to protect dealerships that were independent entrepreneurs, as well as consumers and local communities. These laws also allowed major auto manufacturers to sell their cars without the need to spend resources opening stores nationwide.

Over time, power within the dealership realm began to consolidate, with large publicly traded dealership groups, like Lithia Motors and AutoNation, buying up and combining independent dealerships. This, of course, means higher costs for the customers while the revenue of these companies continues to rise.

For the year 2023, AutoNation reported $27 bln in revenue and Lithia Motors reported $31 bln.

A car is one of the most expensive consumer products, and despite the franchise laws claiming to protect the consumer, this hasn’t really been the case. Things, however, have been taking a turn with electronic car maker Tesla selling automobiles directly to the public and uprooting the traditional franchise system.

What’s the Difference Between the Two? What Does Each Have to Offer?

The automotive industry has relied on car dealerships for a long time now. The primary purpose of these dealerships is to sell new as well as used vehicles to customers. Other functions of car dealerships include providing associated services such as trade-ins, financing, and after-sales services.

Dealerships are a capital-intensive business that requires a decent amount of upfront capital to acquire or rent a workshop and have inventory. Auto dealers keep new and used vehicles from different manufacturers and when selling them to customers, they allow customers to test drive all the options that they have in mind before making the final purchase. They also accept trade-ins from clients in a hassle-free manner, helping them save money on new purchases.

Dealers further need skilled manpower for different departments: sales, finance, accessories, insurance, service, car parts, and back office. Their knowledgeable sales employees address clients’ inquiries and give them details on various models and amenities. Overall, the professional staff helps customers make the right decision based on their needs and budget.

Dealerships collaborate with banks and other financial institutions to help customers find various financing solutions for their cars. Meanwhile, after-sales services, such as maintenance and repair, parts and accessories, and warranties, provided by auto dealers help customer vehicles remain in good condition.

This is how car dealerships have become an indispensable part of the car-buying process which offers the benefits of convenience by providing all the car-related needs at one location.

However, car dealerships are not without their challenges; the primary one being stiff competition from online services and private sellers, which means they must offer competitive pricing, financing alternatives, and quality after-sales services to stay on top of their game. Then there are changing customer preferences, for instance, electric vehicles (EVs) are in trend today, as such, a dealership must stock the latest inventory to meet customer demand. Other challenges can be in the form of increasing operational costs and limited inventory.

For customers, dealerships’ high markups and pressure sales techniques are a big negative. Also, they have limited negotiating power, so there is not much room to get the best price possible on a vehicle.

When it comes to types of dealerships; franchised is the most prominent one where manufacturers permit selling and servicing their automobiles. Then there are independent auto lots, used car dealerships, luxury car dealerships, and online dealerships.

While for over a century dealerships have been the ones fluffing the car demands of customers, the direct-sales model is fast gaining traction. It involves original equipment manufacturers (OEMs) selling their vehicles directly to customers without going through an intermediary like dealerships.

In 2021, with lockdowns and social distancing, auto manufacturers had to resort to offering the option to purchase cars online. Buying a car directly and online is a quick process that customers prefer.

This way, auto manufacturers realize higher price points, as removing the middleman allows them to retain a large portion of the selling price and enjoy an increased profit margin. They can also use customer data to improve their technology, refine their products, and build strong customer relationships.

While direct sales are starting to gain adoption, it is not without its challenges. Customers are not fully satisfied with the current online buying options. Also, a customer has limited finance options here compared to buying from a third party.

You can bargain at a dealership, but when buying directly from a company, you only get discounts that are officially offered. However, this also means you are paying the established price, and everyone is getting the same deal, so you don’t really need to hassle for a lower price or to do comparison shopping.

Another challenge comes in the form of franchised dealer groups and associations gearing up for a legal battle against this shift, arguing that such a move will effectively cut them out of the automotive sales ecosystem. Dealerships, for obvious reasons, are not happy with this; however, the automotive direct-sales model is coming, and there’s no stopping it.

It’s not just the auto dealers; manufacturers, too, aren’t prepared for such a shift either. After all, they now need to consider their resources, competition, and capabilities. Given their little hands-on experience interacting with the end customer, they need to understand the complexities of the business they are getting into. In addition to facing legal hurdles, car makers have to deal with supply chains, inventory management, and servicing and maintenance.

Are Direct Sales About to Take Over?

There’s already a shift happening globally, where automakers are increasingly leaning towards implementing the direct sales model. On the regulatory side, some US states are also altering the language of laws to address the evolving vehicle marketplace.

Elon Musk’s Tesla has been at the forefront of employing the direct sales model despite initial opposition. Selling vehicles directly to consumers has allowed the company to control the entire customer journey, right from ordering to delivery and servicing.

Following Tesla, other EV manufacturers, Rivian, Polestar, and Lucid, have also taken to selling directly to consumers. Established car brands like Land Rover, Cadillac, and Genesis, are among those who have started introducing pop-up shops to build a direct connection with customers without violating local laws.

Chinese EV manufacturer Xiaomi Automobile also announced earlier this year that it will sell its cars through direct sales and dealerships. The company revealed its first EV model, the Xiaomi SU7 sedan, late last year, and it is slated for launch soon.

The sales channel will be based on a “one plus N” model, where ‘one’ represents Xiaomi Auto’s self-built and self-operated delivery center, and ‘N’ stands for the agent sales and user service points. The company will also recruit for its stores in 17 Chinese cities with a focus on those with experience in new energy vehicle brands.

Amidst this, the troubled EV company Fisker also added dealerships to its direct-to-customer distribution model. As we have reported, Fisker has been struggling to stay afloat after experiencing one setback after another and this move has been to improve its sales.

Then there is Hyundai Motor, which has partnered with tech giant Amazon on an online vehicle retailing program to allow buyers to complete end-to-end car-buying transactions on Amazon by the end of this year. Amazon wants to extend this car-buying process to other brands as well, aiming to transform it into a click-to-buy shopping experience.

The model is being tested in major markets including New York, Seattle, Los Angeles, Denver, and Atlanta. In Feb. this year, Hyundai reported its first sale to an Amazon employee on the retail platform and the subsequent delivery.

According to dealers, this Hyundai and Amazon collaboration can lead to a more direct-to-consumer sales model. However, this will, according to them, affect their profit margins and be unsuitable for long-term customer service.

Even luxury car manufacturer Mercedes-Benz shared its plan a couple of years ago to implement a direct selling strategy in 15 global markets by 2025. This step is expected to cut down 10% of the company’s global dealer network and as much as 20% reduction in Germany alone. Mercedes-Benz projects 70% of its volume in Europe to come from direct sales at this time. The company further estimates one in four buyers to purchase their next car online by next year.

The model has already proven to be beneficial to Mercedes-Benz globally, allowing it to reduce distribution costs and have more control. With customers in mature markets getting “younger, wealthier, and more digital,” the company believes they need fewer big dealerships in those regions.

Another popular car brand, BMW Group, launched a direct sales model across Europe this year. It started with MINI in Sweden, Italy, and Poland, with plans to roll it out throughout the continent and digitalize the whole process. The new model, the company said, will benefit customers with standard nationwide pricing.

“The aim of our new sales model is very clearly to increase customer satisfaction and offer the best premium customer experience in the industry.”

– Pieter Nota, responsible for Customer, Brand, and Sales at BMW AG

While companies are increasingly taking the direct sales route, dealerships are not happy and are retaliating. In one such move, the Automotive Trade Association Executives called out Honda Motor and Volkswagen Group in an ad last month to not sell their EVs from Sony Honda Mobility and Scout outside of their franchised dealer system.

Scout is a brand formed by Volkswagen that plans to start producing its vehicle in 2026, while Sony Honda Mobility is an alliance between Honda and Sony to develop the EV brand Afeela, which will start production next year and begin selling the year after.

The ad, which suggests dealers pursuing legal channels if these companies attempt to sell directly to consumers, is supported by 50 states and 21 metro associations. The ad read:

“To avoid potential legal challenges across the nation and ensure full compliance with applicable laws and regulations, the surest path to sales success is through franchised dealers.”

This comes “after two years of asking and getting nothing, frustration is very high,” with John Devlin, 2024 chairman of the Automotive Trade Association Executives adding:

“If they want to sell the vehicles direct, it’s going to be an incredibly difficult battle.”

Companies Adopting Direct Sales Strategy

Now, let’s take a look at two prominent names that have adopted direct sales strategy successfully:

#1. Tesla

This company has fully embraced the direct sales model to sell its EVs directly to consumers through its own website and stores. Tesla produced 433,371 vehicles in 1Q24 and delivered 386,810.

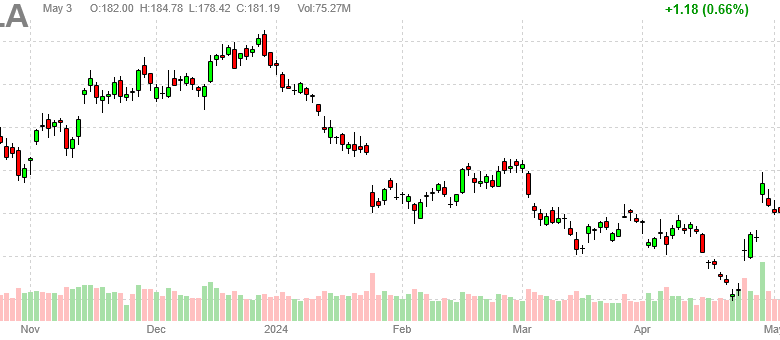

The company has a market cap of $374 bln, and its shares are trading at $182, down 27.56% year-to-date (YTD). Tesla’s revenue (TTM), meanwhile, has been $94.7 bln, and its EPS (TTM) is 3.91, P/E (TTM) is 46.04, and ROE (TTM) is 24.28%.

#2. Rivian

This EV manufacturer is also selling its electric trucks and SUVs directly to consumers through its website. The company produced 13,980 vehicles and delivered 13,588 in 1Q24.

Rivian’s market cap is $9.78 bln, and its shares are trading at $9.92, down 58% YTD. The company recorded revenue (TTM) of $4.43 bln while having an EPS (TTM) of -5.74, P/E (TTM) of -1.71, and ROE (TTM) of -47.36%.

Conclusion

Over the past few years, driven by pandemic-related supply chain shortages, the automotive industry has taken to selling its vehicles directly to customers, forgoing middlemen, i.e. dealerships. While the trend is clear, with more and more companies taking this route, it’s still early in the game, with laws yet favoring dealers. However, increasing digitization, technological advancement, and customers preferring to shop online points to direct sales becoming the future of the automotive industry.

Click here for a list of the top ten EV stocks.